What Is ChexSystems – Are You Blacklisted?

Daniel Long

Updated May 03, 2024

When you apply for a new checking account, most financial institutions like banks and credit unions will review your ChexSystem report. Only after that, will they decide whether to approve or deny your request.

ChexSystems is a reporting agency that informs banks of the potential risk to their institution. Your ChexSystems report is a tiny part of a huge database. It includes bad records of your relationships with banks and credit unions. Yes, you’ve read it right! Only bad records.

When the bank clerk sees this report, it can be the deciding point of your account getting approved or denied. That’s why it is extremely important to know about ChexSystems reporting. Knowing how and what can cause a report to go against your favor may make a huge difference in your ability to be served by U.S. banks and credit unions.

What is ChexSystems?

There are thousands of commercial banks in the United States. They serve several hundred million customers. These are mostly U.S. citizens, but also foreign residents and international travelers.

Banks try to protect themselves from dealing with unreliable clients. And not only do they try, but they have already created an organization that collects data on customer misconduct that they decided to share with each other.

Is it legitimate? Yes, completely!

ChexSystems is governed by FCRA (Federal Fair Credit Reporting Act).

Who is behind this company? Quite an interesting question! And here is an answer:

FIS is a humongous American Fortune 500 company that works in the financial sector and has a market capitalization of over $80 billion.

eFunds Corporation (EFD) is also a financial company. Not that big, though. It provides electronic debit payment solutions, risk management tools, and other services.

The banks' logic was very straightforward: if a client is dishonest or careless, for example, writes bad checks or does not pay service fees, he is likely to behave the same way when cooperating with another bank.

Basically, ChexSystems is a huge database that stores information about your cooperation with the banking system. Only bad information as it was stated before.

To avoid wasting time and money, when a customer goes to a bank to open a checking account, the bank simply submits a request to ChexSystems and checks the customer's eligibility. This happens automatically and does not take much time.

There are no generally accepted industry standards, so each bank decides for itself whether to serve the customer or not.

- Some banks turn down clients right away. The number of banks that work with ChexSystems is about 80%, i.e. 4 out of 5.

- Some offer a product called second chance banking (almost the same account, but banks do not deny themselves the pleasure of limiting the options of online banking, as well as charging extra fees).

- Some don't work with ChexSystems at all. These are mostly new online banks that do not have physical branches and some traditional banks.

A ChexSystems report includes data submitted by banks or credit unions for the past five years. But it's too much to wait for your story to clear up. So the sensible solution is to always be aware of what records are stored in ChexSystems and, if necessary, take steps to remove them from there as quickly as possible.

Some people are concerned about their credit score, but may not even be aware that there is such a company as ChexSystems. This is the reason why there are regular discussions about checking account denials when you have a good credit history.

That's how people find out about the company, get their report and take steps to get banks to open and service their checking and savings accounts.

The fact is, the decision of whether to open a checking account or say sorry, is usually based on ChexSystems, not on credit bureau reports.

What Is in My ChexSystems Report?

It’s important to know that ChexSystems doesn’t capture your positive data. Properly managing your credit card is good for building your credit score, but this information is not included in a ChexSystems report.

Many people get confused between the credit bureau report and the ChexSystems report. A credit bureau report only has a history of debt handling by the consumer. But ChexSystems reports a lot more. Typically, they are looking for multiple types of bad data. This includes:

Check Overdrafts

Statistically, this is the most frequent cause of a ChexSystems report. Some of the reasons:

- Spending more money than you have in your bank account.

- Writing a cheque that your balance cannot cover. Due to fraudulent activity, your account will be closed by the bank if it notifies that it has been misused or if the account holder is habitual of writing a bad check.

- Trying to deposit checks written by other people without even knowing that they are bad.

Fraudulent Check Deposits

Check fraud results in over $1 billion a year. On average, a victim loses from $3,000 to $4,000. On top of that, attempted check fraud spiked 43% in 2 years, reports pymnts.com.

The problem is, not every fake check can be easily identified. Even bank employees have a hard time identifying them as fraudulent.

The typical scheme works like this:

- A person asks you to deposit a check;

- You deposit a check;

- A person asks you to buy gift cards (another option is refusing a portion of a check amount);

- Only in a few days or even weeks, the bank figures out that the check is counterfeit;

- The trouble is, not a cheater but you are responsible for paying back the money to the bank.

Not only does it require paying overdraft fees, and may lead to closing or freezing your bank account, but also damages your credit and affects your history. If the bank works with ChexSystems, it will report this case, and you will experience multiple problems later.

Every person holding an account may have committed some kind of mistake once in a while. Even though one mistake doesn’t seem a big deal, if the report suggests a consistent behavior of checks being bounced, it can and in the overwhelming majority of cases will be reported to ChexSystems.

Debit/Credit Card Abuse

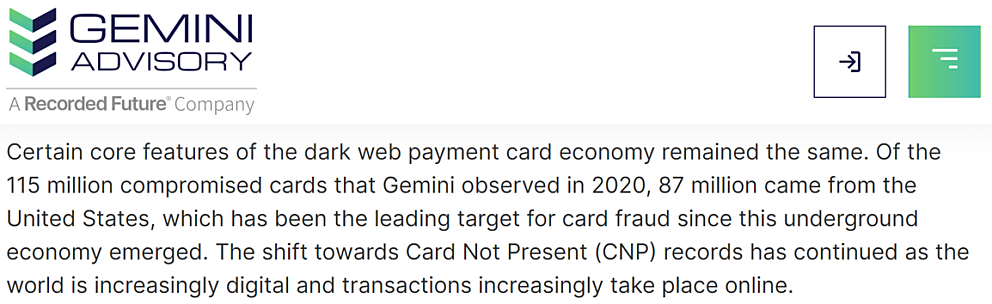

This includes using your debit or credit card to gain profits by fraudulent means. It occurs when someone gets access to your card and makes an unauthorized purchase. Today, the hackers only need to know your card data (such as number, expiration date, and CVV code), they do not have to get a physical plastic card in their dirty hands.

If you think that the only way to get your card details is to use an ATM card skimming device or something like that, you might be surprised to know that criminals are selling literally millions of stolen card numbers on the Dark Web. According to Gemini Advisory, in 2020, 87 million stolen debit and credit were posted to different online marketplaces.

Suspicious Behavior

Suspicious behavior is a general term that basically refers to any actions that even a well-respected person may take without knowing they affect their banking history.

One of them is structuring. Imagine, you want to deposit $15 thousand to your bank account, but for one or another reason, you don’t do it within one day, but deposit $9 thousand today and $6 tomorrow.

To be precise, you face no legal consequences, but in the US, the bank has to keep a record of all cash deposits of over $10 thousand. Even though you have every right to deposit $15 thousand in two days, this is considered suspicious behavior.

In short, structuring is when you modify your deposits to make your transactions under $10 thousand. It may and typically is reported to ChexSystem even if you haven’t done anything wrong!

Just because you think your ChexSystems is clean doesn't mean it really is.

There are plenty of stories on myFICO about how users have encountered unexpected difficulties when opening an account. As it turned out later, the issue was that they had unknowingly gotten into ChexSystems, and are now potentially dangerous customers for banks working with the agency.

It is worth bearing in mind that some customers abuse the bonus system and having problems is their fault. Nevertheless, they earn thousands of dollars each month.

This kind of action cannot be considered a serious approach to managing finances, because in the future banks may refuse not only to open a savings account but also to provide a loan or a mortgage.

Negative Balance

A negative balance can accrue due to unpaid fees and other charges like fees accruing even after zeroing your account but not closing it. Not addressing this issue in a reasonable amount of time can get you reported as well.

You will need to go to the source, to the bank, to see what they want in order to remove that negative. In most cases, it means paying off whatever you owe and then also paying any fees related to it.

This means, if your account is negative, do not close it, pay it off first before doing that and just settle all your balances.

Keep in mind that banks are tracking your every move and what you choose to do with your account. Therefore, keep an eye out for negative balance to save yourself from major headaches in the future.

Too Many Inquiries

This might sound weird because it seems that the more accounts a person has, the more actively they manage their money and the more accurate they are. But many inquiries can have a bad effect on perfect banking history.

Certain banks will deny opening an account for you if you have 10 or more active accounts. The thing is, in some cases, when you open an account, you are rewarded with special bonuses and extras. There are even some “extra money seekers” opening multiple accounts. This is quite understandable and doesn’t violate any law. But still, Reddit users report that after ordering their ChexSystems reports they noticed a bunch of inquiries.

There are no “save numbers”, but as a matter of common sense, if you open tens of bank accounts in a year, this may and will be more problematic to both manage your money and maintain a positive banking history, even if you don’t make any mistakes.

And again, for the most part, this affects people who are drying out different bank accounts and maybe getting bonuses.

A financial expert who specializes in solving different kinds of financial problems related to credit cards, savings, and checking accounts, Ask Sebby reports that he has heard of some people who got rejected online once they hit 12 inquiries. Once they went into the branch it was fine again.

There is no clear data if that required a manager's approval or what happens but this is something to consider if you do have a lot of inquiries.

How to Avoid Being Reported to ChexSystems

Even if you have only one negative thing on your account it may be difficult to get any bank account opened. ChexSystems really punishes you for your mistakes.

The only way to stop being reported by ChexSystems is to manage your accounts with a sense of responsibility. Here are a few tips that you can do to prevent being reported.

- Make sure, you don’t write any checks that can’t be cashed. Writing bad checks can be easily avoided if you know how much money you have in your bank account. Make a habit of monitoring your account each time before you’re going to write a check. This will help you both save money and avoid overspending.

- Don’t do any fraudulent stuff or weird deposits. Remember about suspicious activities. If you do want to deposit over $10 thousand, do it within one business day. There is nothing to be worried about. Yes, this will be reported to the federal government, but the only reason why the feds are tracking such transactions is to curb illegal activities like money laundering.

- Always keep enough money in your accounts until the check is cleared. On average, it takes about three to five days. A bounced check is a major cause of your account being over-drafted. This is reported to ChexSystems and affects your banking history.

- If you do pull up your ChexSystems report and realize that there is something weird about it or something that you didn’t expect, try all that you can to bring your account back into shape. Even if you don’t have the money to pay off all the balance, call the bank or better visit a branch to talk to a bank manager and explain your current situation. Banks are interested in keeping you as a customer for as long as possible. They don't aim to make you pay as many fees and penalties as possible to get you to give up their services. A face-to-face conversation is the best thing you can do if you are unable to pay your obligations at this time. You can still work with your bank or other banks if you continue to be in constant connection with them.

- Always close your accounts properly. Just zeroing out your balance is not enough. The thing is, an open account can still accrue fees that can pile up over time, thus negatively affecting your account. Check, if there are any automatic payments, discontinue them immediately. Keep track of all the places you have ever used your account for automatic payments and cancel them when you want to close it.

Defining Account Abuse

In fact, the only real reason why banks work with ChexSystems and other reporting agencies is to check if your behavior poses risk to them.

Some banks, which are called second chance banks, do check your ChexSystems report but offer second chance services, that is, less favorable conditions than for regular customers. But in most cases, ChexSystem is an alarming sign, regardless of whether getting in trouble was your fault or not.

There is no official definition for account abuse, but the fact remains, ChexSystems has its own SOPs to gauge out negative behavior and does not disclose its methods of doing so. At the end of the day, account abuse is when a bank believes that a consumer has not complied with the terms of one or several of their accounts, and may again pose a risk in the future.

This has raised many concerns about the lack of transparency and the way the entire financial system works. For instance, low-income individuals are likely to accrue negative balances in their accounts due to overdrawing. If the consumer cannot afford to pay the fee, the account will accrue a negative balance which can pile up. There have been voices to change the way banks and financial institutions screen their consumers, but for the present day, nothing has changed.

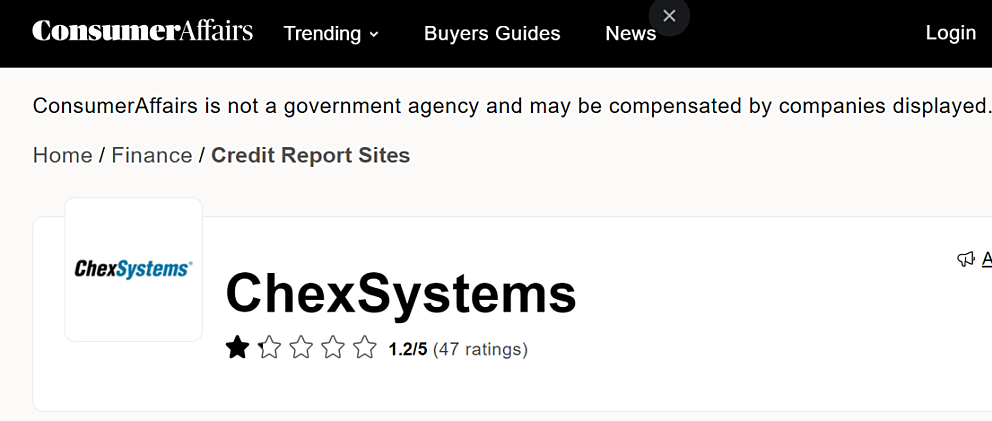

Not surprisingly therefore ChexSystems has an average rating of 1.2/5 on ConsumerAffairs:

On top of that, due to the quarantine, millions of Americans lost their jobs and could not pay their fees, commissions, debts on time. This led to a significant increase in the number of reports in the ChexSystems database.

In short, account abuse is about the “once a cheater, always a cheater” mentality, which is definitely not always the case. Especially, when one day you get confused about your checking account and why your checks are no longer clearing.

Regardless of the definition, financial abuse and a bad ChexSystems report cause devastating and irreparable harm to both young and elderly victims.

How Do I Know If I Have a ChexSystems File?

As for now, ChexSystems holds credit data of over three hundred million customers in the United States, so having a ChexSystems file doesn’t make you a black sheep.

There are several possible ways to request your free report:

- Call 1-800-428-9623. In this case, you will have to go through ChexSystem voice messaging system and verify your personal information.

- Visit the ChexSystems website and fill out a consumer disclosure form.

- Request a report by mail. Download a form, fill it out and mail it to ChexSystems. The address is 7805 Hudson Road, Suite 100, Woodbury, MN 55125. Don’t forget to put on the envelope the following address “Chex Systems, Inc., Attn: Consumer Relations”. On average, you will get your report in about a week starting from the day you send your mail.

- Use fax. Download the same form, fill it out, and instead of mailing it, fax your request to (602) 659-2197.

Since you get the same report in all cases, there is no point in using fax or making a phone call. It's much easier to send an online application and get your report as soon as possible.

How do I get my name off of ChexSystems?

First, you have to get your report to figure out what is wrong with your bank history. Two further cases are possible.

- If you find some wrong information, gather all the supporting documents and follow the dispute information page.

- If you realize that your support is accurate, the only possible way to solve the problem is to pay off your debt and do what is needed to get back on track. In this case, there is no need to send any messages to the ChexSystems support team, because this is the bank you owe that has the power to “improve” your history.

Even if all your debts are paid off, this doesn’t mean that your ChexSystems file will be automatically updated. This takes some time. So, it’s better to ask your bank to get in touch with ChexSystems and update your file.

Disputing the errors with ChexSystems may be quite a challenge. You can actually tell them that the information that you have found is incorrect. It only really works if it’s something that’s invalid. When they realize that it’s valid, it will go back to your report.

Be patient! Following the Fair Credit Reporting Act, ChexSystems has thirty days to verify and eliminate negative marks. If you don't hear back from ChexSystems within 30 days, and you believe you have provided complete information, send a letter and refer to the Fair Credit Reporting Act and outline your intent to sue. Also, send a letter to the bank whose agreement you allegedly violated and ask them for proof. Neither the bank nor the company should have any intention of ignoring you, but if for one or another reason this happens, the only option is to take it to the small claims court.

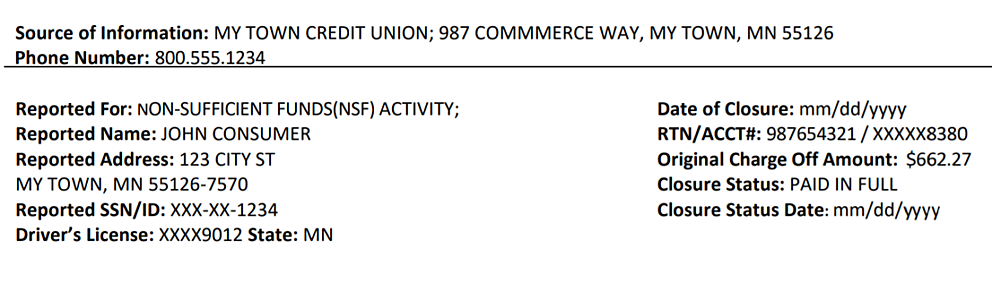

What does the ChexSystems report look like?

You don't have to be a financier or an accountant to understand what the ChexSystems report contains.

It is designed for ordinary people, so the information it provides is very easy to understand.

Here is an example:

You can see the reason a customer was reported for, his name, address, date of closure, original charge off amount. The most important part is the source of information. If what you see is correct, get in touch with a bank or a credit union to figure out what to do next.

How to Open an Account While You Solve Problems With Your ChexSystems Report?

The most probable outcome that you are going to have after being reported through ChexSystems is that the banks are going to deny your account. Most of them. In that case, you will have to do without a checking account and take actions that will make a good impression on your ChexSystems report.

Some banks may offer you what is called a “second chance account”. They are called second chance banks and are focused on giving those who have financial difficulties the opportunity to use banking services as other customers.

But even though second chance checking accounts and other products are promoted as full-featured, customers may be asked to pay higher fees. Also, a second chance checking account may have higher fees and lack some of the benefits and features of a regular checking account. What this does is that it balances the risk that a bank may suspect from a potential consumer.

If you can show and prove that you are more responsible, the next report may have a positive impact and your chances of getting a checking account may increase. You can even upgrade your account at a second chance bank without improving your ChexSystems report.

How to Avoid Being Reported to ChexSystems

There are three ways to stop being reported by the ChexSystems.

Second Chance Banking

Obviously, you can use banks that offer second chance checking accounts and second chance banking. There is nothing wrong with that, and millions of Americans do it.

They get access to managing their money, and for many years are customers of one or more second chance banks. But such an approach to the use of banking services cannot be called wise or prudent. Everyone can have a bad credit history, be a victim of fraud, or simply forget to pay a fee.

The very fact of getting into ChexSystems does not in any way put an end to your relationship with commercial banks.

Online Banks

Nowadays, there are financial institutions that call themselves fully online banks. They have no physical branches and are trying to win the banking niche by taking it away from traditional banks. Chime, N26 - you have probably seen advertisements for these companies.

They offer convenient conditions, hybrid programs that have both savings account and checking account features. Many of them do not work with ChexSystems or any other agencies because they are interested in growing their client base as fast as possible.

Perhaps the only reason you might be turned down is evidence of fraudulent activity or the like. Your financial relationship with such banks is not transferred to ChexSystems, so even if you make a late payment or forget to pay any fees, you will deal with your bank.

Say No to Banks

Do not use banks at all. While this sounds like a joke, according to CNBC, a total of 14.1 million American adults are unbaked.

But you definitely don’t want to join that crowd, because the real cost of being unbanked or underbanked, is pretty high, reports Forbes.

The only way to stop being reported by ChexSystems and to keep using traditional banking services as hundreds of millions of Americans do is to manage your accounts with a sense of responsibility.

I’ve Been Denied a Checking Account, What Now?

Don’t Panic!

If you have any idea why this may have happened, contact the bank or credit union you owe money to and settle your debt. You can also try another bank. There is also nothing wrong with asking the bank manager what the reason for the refusal is. In case there is no clear answer or you have suspicions that something is wrong with ChexSystems, request a report!

Dispute Errors

If you are sure that your account has been reported due to an error in the system, you can immediately file a dispute with both the bank and ChexSystems. Let them know that they provide information that was inaccurate. Keep in mind that before doing that, you must investigate and establish your claim thoroughly before filing a dispute.

Consider Alternative Options

Life does not end if you have been denied a checking account at one or more banks. Stay calm and look for alternatives. It is not an issue if you have been denied a checking account as you can always go for other products like the second chance account. It can be costly, but it's a good start to rebuilding your reputation.

Also, there are low-risk accounts that lack some of the other features like overspending protection or debit cards, but using these can help you start to build anew.

Be proactive!

Do not accept that you are a dishonest customer, even if there are good reasons for it. You can start rebuilding your history immediately.

- Make sure that you clearly understand the reason for the problem;

- Settle your account (accounts) as quickly as possible;

- Ask the bank you owed to send a notification to ChexSystems;

- Apply for a second chance checking account at a second chance bank with an opportunity to revise and upgrade if used in good faith.

ChexSystems – Frequently Asked Questions

How long does it take ChexSystems to clear?

You can either wait five years or act to improve your report and use banking services as a regular customer. If you have settled your debts with the bank, make sure to ask a manager to send a notification to ChexSystems. They do not have to do this immediately, but they can if you ask them to.

How do you get off of ChexSystems?

To get removed, you have to dispute the bank that reported you or dispute the ChexSystems report. But in most cases, the easiest way is to pay off your debts and ask a bank manager to send a notification to CS.

Can I see my ChexSystems report online?

Yes, you can. To do this, request your ChexSystems report. You can do it for free once a year. You will get a PDF file that contains information about your delinquencies and other actions reported by banks and credit unions.

What banks do not use ChexSystems?

Many of them, but not too many. Some of them are Chime, BBVA, SoFi, United Bank, US Bank, and others. See more options in our comprehensive guide to the banks that don't use ChexSystems. You may also want to consider some credit unions, such as Navy Federal Credit Union, Southwest Financial Federal Credit Union, and Langley Federal Credit Union.

Do all credit unions check ChexSystems?

No. In total, over 80% of banks and credit unions review their applicant’s reports. If you’re looking for credit unions that do not check ChexSystems, search for second chance credit unions.

Can you pay to get off ChexSystems?

You can pay off your debt, that's the easiest way. There are no paid services that can clear your records.

Will Bank of America remove me from ChexSystems?

Bank of America, like any other commercial bank, will remove you from ChexSystems in exchange for payment. It's not a bribe or anything like that, it's just a way to get you to be a reliable customer.

What is a good ChexSystems score?

The ChexSystems score system is based on defining a risk level. Scores range from 100 to 899. The higher your score, the better, since this means that you have a low-risk profile. This score is not sugar level, so you shouldn’t pay too much attention to it if everything goes OK. On the other hand, it is important to know that 580 is considered an undesirable risk level, 545 – moderate, 525 – aggressive.

It takes so long to improve my ChexSystems score, what can I do instead of waiting?

You can always open a checking account at a second chance bank. Read our article ‘Banks That Don't Use ChexSystems’ to find an offer that suits you best. There are dozens of opportunities – BBVA, Chime, GoBank, and many other.

I was late in paying the fee, will this be reported?

Not necessarily. You don't have to be paranoid. But remember, the road of 1000 miles starts with one step. The same applies to financial difficulties. A huge debt starts with one late payment.

Bottom Line

ChexSystems has been around for half a century. There is no need to fear or worry if you have a bad record. At the end of the day, everything depends on you.

You always have different options. But the best one, of course, is to do whatever it takes to be able to get the financial products you need by making ChexSystems play in your favor!

References

- What Is ChexSystems? by Ben Luthi. Published April 18. 2020

- What Is ChexSystems? Everything You Need To Know [2021] by Christy Rodriguez. Updated April 26, 2021

- How to Open a Savings Account in ChexSystems by Ashley Donohoe, MBA. Updated February 03, 2021

- Banks That Don't Use ChexSystems by Catherine Armstrong. Accessed June 6, 2021

- What is ChexSystems and How Do I Deal With It? by Chris Moon. Accessed August 11, 2021

- What Is ChexSystems? Definition & Examples of ChexSystems by Miriam Caldwell & Somer G. Anderson. Accessed 21, 2021

- What Is ChexSystems and What Does It Mean If You Are Blacklisted? by Jared Nigro. Accessed August 18, 2021

- ChexSystems – Have You Been Denied a Bank Account? by Lauren Ward. Accessed January 12, 2021

- BLACKLISTED How ChexSystems Contributes to Systemic Financial Exclusion by Maya Oubre and others. Accessed August 20, 2021

- What to Do if You’ve Been Put on the ChexSystems Blacklist by Andrew Tavin. Accessed March 18, 2021