The Definitive Guide to ChexSystems Score

Daniel Long

Updated Sep 15, 2021

What Is the ChexSystems Score?

No doubt you know your credit score. It's a measure of how diligent you are about meeting your debt obligations when it comes to credit cards, personal loans, or mortgages.

A ChexSystems score works in a similar way. It is based on how well you manage your checking accounts.

What else does the ChexSystems score depend on? Does it depend on the amount of money you have in your account, on whether you have a savings account or not?

It's kind of hard to say since ChexSystems doesn't provide any information on this, so the formula remains undisclosed. Quite weird, isn’t it?

What is it for, then? So that banks could rate you right away, without a detailed analysis of your report. They don't have the time or desire to go into detail and review all of the entries in your report. At the end of the day, the bank clerk pays attention only to your ChexSystems score. (You are not even aware that this is happening).

- If the score is high enough, your application for a checking account is approved. If the score is too low, you may be denied.

- Often banks do not inform their clients of the reasons for rejection. So, it is your responsibility to find out what is wrong and to solve the problem.

What Is a Good ChexSystems Score?

The company does not provide any formula for calculating it. In addition, it does not specify which score is good and which is bad.

We know that the score ranges from 100 to 899. The lower the score, the higher the risk to a potential financial institution. So, the higher the score, the better. But how high should it be?

It is commonly believed that 580 is a ‘safe score’. Higher – great! Lower - you may have difficulty getting your checking account application approved.

ChexSystems Score | Potential Risk | Conclusion |

581 | Low | Will be approved |

545 | Moderate | May be approved |

525 | Aggressive | Won’t be approved |

Different banks rate customers differently, so the table above is not the rule.

But if you got your report, and you see that your ChexSystems score is lower than 581, then it should be improved.

You should also be aware that the 9999 code means that not enough information has been found about your banking history to create a score.

High Score or No Score – What Is Better?

If you read our article ‘What Is ChexSystems – Are You Blacklisted?’, you know that ChexSystems is looking for bad data. Only for bad data! If you are a good, reliable customer who has never had any problems with banks, there is a good chance that you won’t have any entries at all.

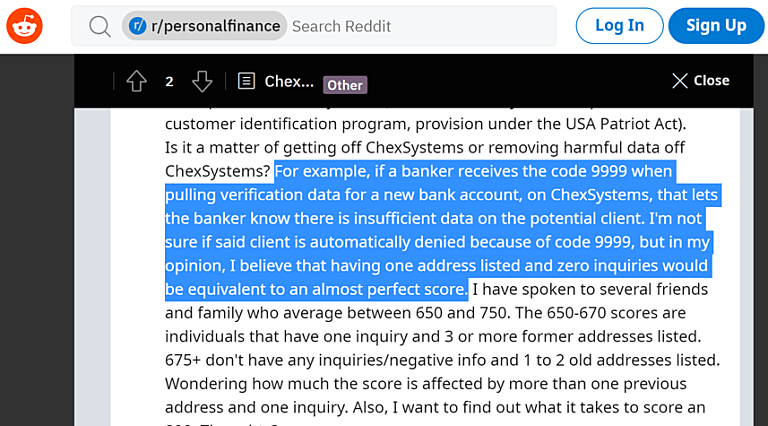

Is it something good and a reason to be proud of? Well, yes! But banks may treat it a little bit differently. Here is what Reddit users found out:

The idea is simple. Not every customer is reported to ChexSystems. If the banker receives the code 9999, they may come across as confused. The reason is that it may be difficult to decide whether you’re just a novice bank customer (this is also considered a risk to a financial institution), or you are literally perfect (slight risk).

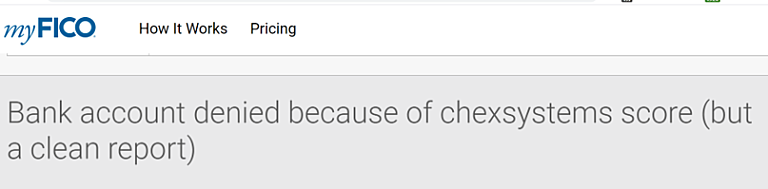

Some of MyFICO members have also encountered a similar problem.

Is having insufficient data a bad thing? No, definitely, not! It would be strange and ignorant if you intentionally delay a payment just to get into a database that many people want to get out of.

But on the other hand, having one inquiry won’t automatically make you a bad customer. On top of that, in this case, your score may be high enough to get approved.

MyFICO users carefully studied statistics regarding the ChexSystems score and concluded that many Americans have no records at all.

How Do I Check My ChexSystems Score?

The easiest way to check your score is to request your free report in one of several ways.

First, you have to visit the ChexSystems official website and fill out the consumer form. You can either submit it online or print it out and then mail it to:

Chex Systems Inc.,

Attn: Consumer Relations, 7805 Hudson Road, Suite 100,

Woodbury, MN, 55125.

Basically, there is no need to use the postal service, as you will end up with the same report as online.

Also, you can use a fax. Download the form, fill it out and fax your request to (602) 659-2197.

You will receive the report within five business days.

A ChexSystems score is also called a ChexSystems consumer score or Qualify score.

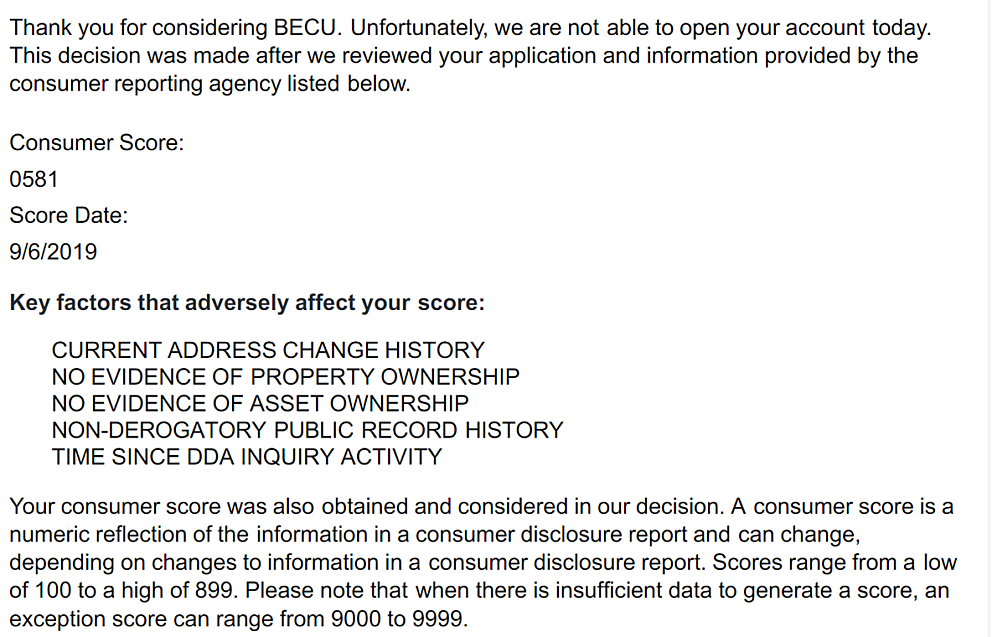

Also, you can find out your score if you applied for a checking account and got rejected. Here is an example:

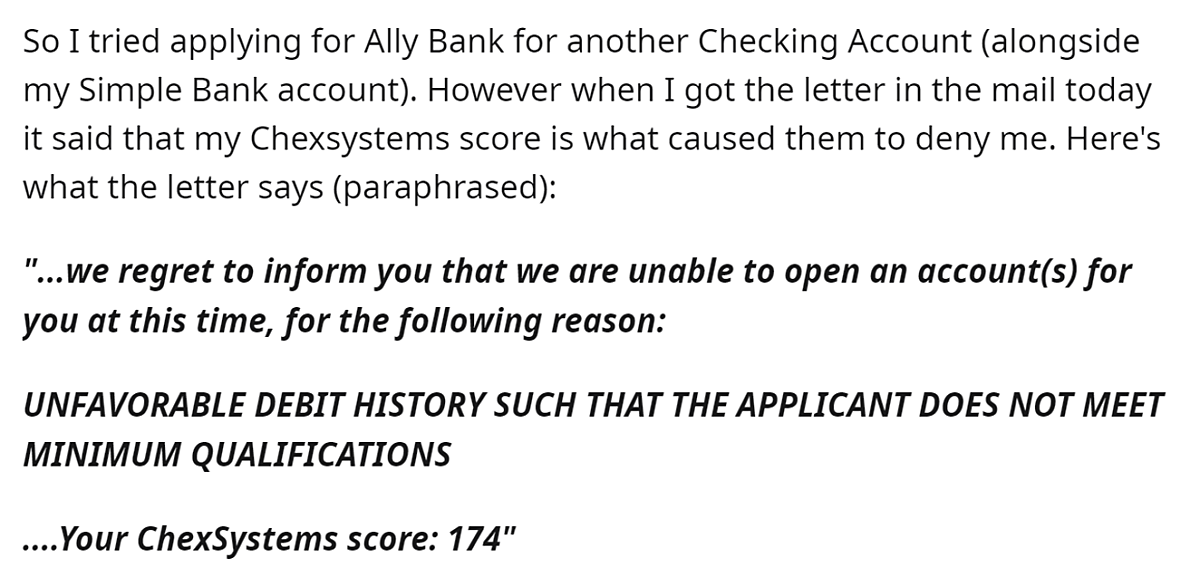

Here is another example from Reddit:

Can My ChexSystems Score Be Incorrect?

We all make mistakes. For this reason, your ChexSystems score may be completely misleading.

To understand why this is the case, it is necessary to understand how it is formed.

ChexSystems uses a wide variety of sources of information. It gets literally millions of reports from banks and credit unions on a daily basis.

Despite the fact that it uses a digital workflow, an error can still occur. And you may not know about it at all.

Having an incorrect ChexSystems score is not your fault, but this is you who will suffer from this. Don't worry, though! You, as well as any other customer, have the right to dispute it with ChexSystems.

Can I Dispute My ChexSystems Score?

Yes, you can!

If you requested your report and found that something was wrong, you should definitely take proactive steps to resolve the issue.

You can do it in one of three ways:

- By phone. Call 800-513-7125 and speak to a representative. This is the best choice if you don’t have supporting documents. Also, it makes sense to call if you want to make a dispute involving identity theft or fraud.

- Online. Go to the ChexSystems dispute center and submit your information. You will have to fill out a form and upload supporting documents.

- By mail. Go to the ChexSystems dispute center, download a dispute form, fill it and mail it.

- By fax. Download and fill your report, after that send it to the ChexSystems dispute center fax number 602-659-2197.

To succeed, you will have to provide as much information as possible including the source of dispute information, types of disputed information, dates associated with the item being disputed. It is important to insert details on why, in your opinion, the information is inaccurate. For example, you can go as follows:

- I’m the victim. I don’t recognize any of the accounts on my report. (Attach a copy of the FTC identity theft report).

- My report shows I owe money to the bank. But I have already paid off the debt. (Attach a copy of any proof that you have).

To be successful, you need to provide as much information as possible, including:

- the source of the disputed information;

- the types of information in dispute;

- the dates associated with the disputed item.

It is extremely important to specify why you think the information is unreliable and provide the necessary facts. Emotional language should be avoided, as ChexSystems is a large organization that reviews a huge number of applications every day. The more actual facts and supporting evidence, the better!

How Do I Improve My ChexSystems Score?

There are some do's and don'ts.

- Always keep track of how much time it takes for every deposit to be credited;

- Check your balance before you make any payment;

- Check if all checks have cleared;

- Make a habit of requesting a free copy of your report every year. This refer not only to ChexSystems, but also to EWS and Telecheck;

- Understand the differences between a good debt (mortgage, student loan, business loan) and a bad debt (unpaid fees, payday loans, loan shark deals);

- Identity theft is not always easy to track, but you can set alerts any time a payment is made with your card. This will help you take immediate action in case of theft.

- Closing your bank account without making sure all fees have been paid is like cutting up the credit card with scissors and throwing the rest of the plastic in the trash can.

- Developing financial discipline can be difficult. Why not ask your bank if it’s possible to offer you an overdraft protection?

- Cannot make a payment but realize it will hurt your ChexSystems score? No need to apply for a payday loan. Just contact your bank and share your repayment plan with them in advance.

Make the Bank Help You!

Don't underestimate the power your bank has to influence your ChexSystems score. After all, it's the one that got you into trouble. That is why you should contact your bank or credit union in the first place.

It's one thing to deal with ChexSystems. Even if you have the documents you need, it's a long way to go.

It's much easier to get a ChexSystems report and go to a bank or credit union to resolve the problem.

Pay off your debts, make sure you don't have any bad debts (not debts at all!) and ask the banker to give ChexSystems information about it.

This is very important to do, as banks are not required to respond instantly to changes in customer status. So even though you've already paid off your debt, you may have a low ChexSystems score and bad records for several more months. And that's not in your plans if you want to open a checking or savings account at another bank or credit union.

Should I Bother Checking My ChexSystems Score?

Some people may think if I am doing well, should I know your ChexSystems score? What’s the point of that? What difference does it make if I just opened another checking account without any problems?

There seems to be no need for that. Indeed, if you have a checking account, savings account, use credit cards, and other financial products, and you follow the terms, both your credit score and your ChexSystems score should be fine.

This is true, but the situation with the ChexSystems score is very similar to your cholesterol level.

You may feel great, but still have problems with high cholesterol levels. You agree that you should find out about it as early as possible, don't you?

That's why doctors recommend getting a blood test at least once a year. Just to check to make sure everything is okay.

The same applies to checking your ChexSystems score.

If you are doing well, take advantage of the opportunity to get your report for free once a year. Pick any date, such as July 1, September 25, or Independence Day, to get your ChexSystems report.

At the end of the day, give yourself such a treat! It’s free, nice to read, and can keep you out of various difficulties in the future.

On the other hand, it's quite possible that you'll find records that you don't relate to. It is always better to be able to dispute the issues of concern before they prevent you from achieving your goals.

Frequently Asked Questions

How do I check my ChexSystems score?

Request your free report. Call 800-428-9623 or visit the website and fill out the consumer disclosure form. You will get your report in five business days.

How long does ChexSystems stay on your record?

Five years starting from the report day. Just waiting doesn’t make sense. It is much better to contact the source of the information (bank or credit union) and ask them to request removal. In this case, ChexSystems will become obligated to do it.

Does ChexSystems affect my credit score?

No, in no way. Your ChexSystems score has no impact on your credit score, and vice versa. But you must know that if your checking account balance is negative, and this information is sent to a debt collection agency, it may report the case to the national credit bureaus. In this way, your credit score may be harmed.

How do I get removed from ChexSystems?

There are two ways. If you find that the information in your report is inaccurate, dispute it with ChexSystems. Also, you can dispute the bank that reported you. It is always better to try solving the problem with your bank or credit union.

How do you raise your ChexSystems score?

If your balance is negative, pay off anything that you owe. Remember, this won’t clear up negative records automatically, so you will have to ask the bank to report this to ChexSystems.

Can I open a checking account if my ChexSystems score is too low?

Yes, you can. There are dozens of banks that don’t use ChexSystems. They use other ways to measure client’s trustworthiness (including reports from other credit reporting agencies).

Bottom Line

Every American should have a checking account. Moreover, you should be able to open a checking account at the bank that suits you.

Request your ChexSystems report and check your ChexSystems score every year.

Find any problems? Use the tips in this article!

References

- ChexSystems Score: 13 Facts you should know about banking history

- ChexSystems: Everything You Need To Know by Ben Gran. Updated August 6, 2020

- What Is ChexSystems? Everything You Need To Know [2021] by Christy Rodriguez. Updated July 18, 2021

- How to See if You Are on ChexSystems List by Clinton M. Sandvick, JD, Ph.D. Updated May 6, 2021

- What to Know About ChexSystems by Amanda Dixon

- What is ChexSystems & How Does It Work? By Claire Henry