The Ultimate Guide to TeleCheck

Daniel Long

Updated Jun 05, 2022

So, you've spent an hour and a half in the store, picked out a large amount of food for your family, and come to the cash register. It's time to pay!

Just think how you will feel when you hand the cashier the check and he tells you those scary words: "Your check has been denied!"

This is not just an unpleasant situation, but actually a warning sign for both the customer and the salesperson. The customer fears that he has run out of money, and the seller suspects fraud.

Or you may be in the comfort of your home, but receive a notification that you cannot make a payment because of a TeleCheck problem. There are plenty of messages like this on forums and social networks. Take a look at what a Reddit user encountered.

With cybercriminals running rampant, a safe system needs to be in a place that can cater to both parties and allow them valid transactions. This is where the TeleCheck system makes a grand entrance. However, the big question is what is TeleCheck?

On top of that, why is it rejecting your check when you know you have enough money? Don’t worry as we describe to you all you need to know about TeleCheck. Read on as we break down all of its components and working system.

What Is TeleCheck?

TeleCheck is a reporting agency that focuses primarily on customer information on checks and accounts.

It was founded back in 1964. At that time, it was a small check verification company. Its job was to check if a personal check has sufficient funds.

Now it is a fully electronic service that keeps records of customers who write bad checks and have other problems with banks.

According to the ABA Banking Journal, check fraud accounts for 35% of bank fraud. This results in a total loss of about $10 billion each year.

Frank McKenna for Frankonfraud reports that successful fraud rose to more than $1.3 billion in 2018. No wonder why stores and other organizations are so suspicious.

TeleCheck is a pioneer check processing system that merchandisers can utilize to deduce how risky it is to accept a check and decide on the spot if they will approve it as payment. If the TeleCheck system authorizes a check, the seller is ensured that they will get the amount without any chances of fraud. Similarly, if a check goes through successfully, it provides the check owner that their records are clear and their account is safe.

This service helps many vendors when it comes to evaluating payments through checks. It aids in scrutinizing and avoiding any fraudulent activity. There are many banks and financial institutions that opt for TeleCheck to deduce whether or not they should permit a customer to open a checking account.

How Does TeleCheck Work?

When a check runs through the TeleCheck system, it uses the information to discern how uncertain it would be for the merchandiser to accept your check. TeleCheck bases this assumption by utilizing its database tools and risk evaluating system, and it also employs a system that allows merchants electronic check acceptance. Here is a little more information on how these processes work.

TeleCheck structures and maintains a database of information gathered from checks, bank accounts, and debt records. Electronic check processing encompasses debt verification that seeks outstanding debt information about a check writer. The system evaluates the data to observe patterns, recognizes and avoids forgery, and formulates statistical profiles of valid and invalid transactions. TeleCheck utilizes the information examined in this database process to convey the risk level to traders.

Risk Evaluation Model System

TeleCheck employs its risk model system to create acceptance recommendations for checks that await confirmation by traders. A trader provides data from the check and the check writer to TeleCheck either manually or electronically. TeleCheck then scans the information against its transaction database to look for matches that entail overdue payments or other account issues such as prior flagged transactions and such.

The risk model specifies traits of hoaxes and other suspicious factors and establishes a limit of applicable risk. The system marks any transactions that fall below the designated threshold and conveys a rating of three to the trader. The rating warns the merchant that the level of risk is substantial. TeleCheck does not tell if the check is good or if the check writer's bank account has enough funds because it does not have access to that information. It only looks for suspicious activity and works with that.

Electronic Check Approval

To ensure merchants' different levels of verification and coverage, TeleCheck offers electronic check acceptance, too. The company's various check solution products are tailored to fulfill the needs of traders, including those who need the automatic transmission of checks. TeleCheck converts paper checks to electronic payment for merchants to guarantee safe and valid transactions.

The electronic check acceptance service compels customers to submit a signed paper check to the clerk to verify the amount and banking information. After confirmation, TeleCheck passes the acceptance of the check. The customer then signs an electronic transaction receipt for the trader and obtains a copy for their records. The authorization of an electronic check takes as long as a paper check and emerges on the customer's bank statement as an electronic transaction.

TeleCheck Code Alerts

Every time a transaction goes through TeleCheck, the system will always show a code that has an implication and meaning for the fate of the transaction. These codes specify what type of reason could be causing this rejection. Here is a list of these codes and their implications in the majority of TeleCheck systems:

- Approval Code: it can be any combination of four numbers demonstrating a successful approval by TeleCheck. This code is then provided to the cashier and usually written on the check to indicate approval

- Call Center: This code can come with the message 'Call Center'. It means that the transaction cannot be finalized until the cashier phones a TeleCheck call center representative for follow-up with the transaction. The representative will have to verify extra information present in the database and make an authorization

- Code 3: This code symbolizes a denial or disapproval from the TeleCheck network. It indicates that the system did not find any negative information on the check owner, but the check and the owner's info do not meet the standards set to allow the transaction's clearance

- Code 4: This code indicates a rejection from TeleCheck on a more severe level where the database identifies many crucial pieces of information that obstruct the security for the check to be processed. This code is a general alert for significant fraud potential

- Error Entry: This code appears if there is a mistake made from the input by the cashier of the transaction. It can also arise if there are some technical issues within the system

What Does It Mean if TeleCheck Rejects Your Check?

If the TeleCheck system refuses your check, that does not mean that you lack money in your account, it could mean they could not find enough information in their database to decide whether your check should get approval. It could also imply you have unpaid debt that has been marked into the TeleCheck system.

This debt could be owed to anyone who uses TeleCheck and can usually stay on record for seven years. Outstanding debt is one of the major reasons for check rejection as check owners tend to ignore dues, and they pile up and cross the allowed limit.

Other Rejection Reasons

Prior Fraud Report

If a consumer's account was marked to be a victim of fraud previously, TeleCheck has this on record. Even if the case was reported to the bank and resolved, TeleCheck may still flag your account to be high-risk months or years after a fraud event.

Bad History with TeleCheck

This is Code 4, where a consumer who has a history with TeleCheck will most likely face a denied transaction through merchants even if the debt was paid and settled.

Inadequate Data on the Telecheck Database

This is a Code 3 situation and if it means that TeleCheck does not have enough information on a checking account holder. Such a situation makes it rather difficult for the company to foretell if a check is valid or fraudulent.

Wrong Data Entry

The person operating the system may have entered wrong info onto the Telecheck system resulting in error; this can always be a safe case.

Eventually, it is up to the trader to accept your check or not; TeleCheck is solely there as a way to assist the merchant in determining how risky it may be to take your check.

How to Deal with Check Rejection by TeleCheck

In case of check rejection at a retailer, you will receive a seven-digit record number from the TeleCheck system. You can call TeleCheck directly for additional details about that particular rejection by providing your record number.

If you are skeptical that there might be a mistake in the TeleCheck database, you can ask for a copy of your TeleCheck report. By law, TeleCheck is bound to give your report free of charge once a year upon request. You must carefully analyze your report and ask questions regarding anything that may seem a little off or is entirely unfamiliar to you. It is always better to inquire in such situations rather than have it become some severe issue because most of the time, it could only be a systematic error.

How Do I Get My TeleCheck Report?

You have the right to get your free TeleCheck report once a year. According to the law, the company is obligated to provide it to you without any restrictions.

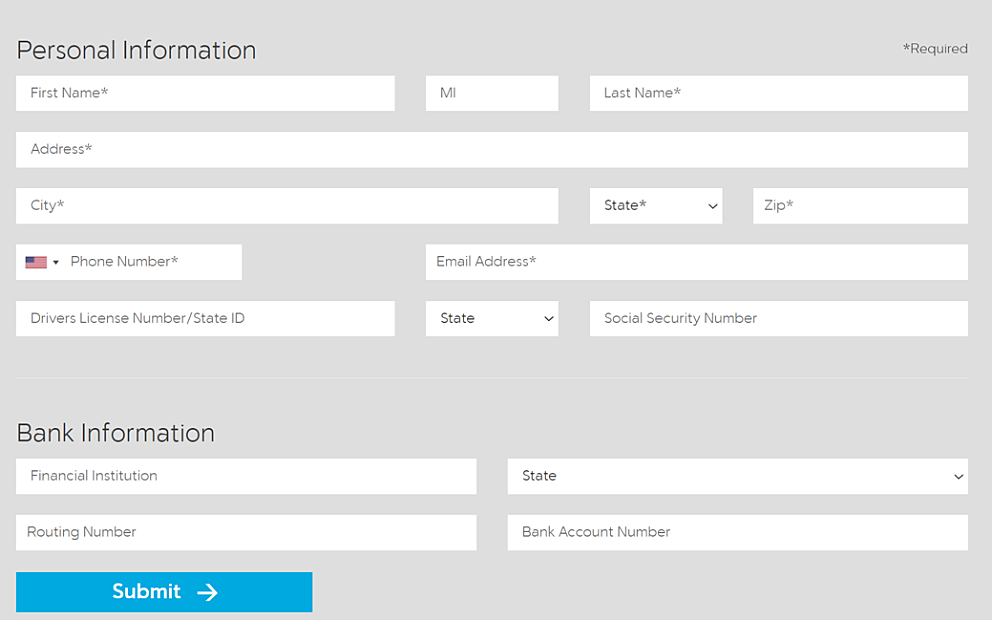

The only requirement is that you fill out the form correctly. If you intentionally or unintentionally make a mistake, even if it is a typo in your name, the report may not be provided.

- Go to the Request your TeleCheck Consumer File Report page on the official TeleCheck website.

- Fill out the form and hit the ‘Submit’ button. You will be prompted to enter personal information as well as share your contacts.

- You can send your request by mail. In this case, you will have to attach other information. This includes your SSN, phone number, driver’s license, and a copy of your voided check. Paper requests should be sent to the following address:

TeleCheck Services, Inc.

Attention: Consumer Resolution Services

P. O. Box 6806

Hagerstown, MD 21741-6806 - You can also just find out if your name is in the TeleCheck database. Call 800-366-1048 and tell the representative that you are calling to find out if you are listed in the system.

How Do I Dispute Wrong Information in My TeleCheck Report?

By reviewing the records on your report, you can immediately see where and at what time you made a mistake. This will help you contact the bank, credit union, or other organization that sent it to TeleCheck.

But sometimes, and it's not uncommon, the information is totally inaccurate. For instance, you can’t believe your eyes because you have no idea where a debt or payment you did not make came from. If this is your case, you should report this fact to TeleCheck as fast as possible.

The company offers two options:

- Download a PDF form, print it, fill it out and mail it in;

- Fill out the Online Dispute Form. You can add as many items in dispute as need.

The most important key to success is to add accurate supporting information.

For some reason size of an individual file should be less than 1 MB, so be sure to use Photoshop or another image editor if your files exceed this size.

Unlike ChexSystems, you don’t have to write supporting letters on your own. Just fill out the form, and the company will review it and make the necessary changes.

But it's not that simple really.

Even if you find a piece of inaccurate information in your report and dispute it, it does not guarantee that your report will be corrected.

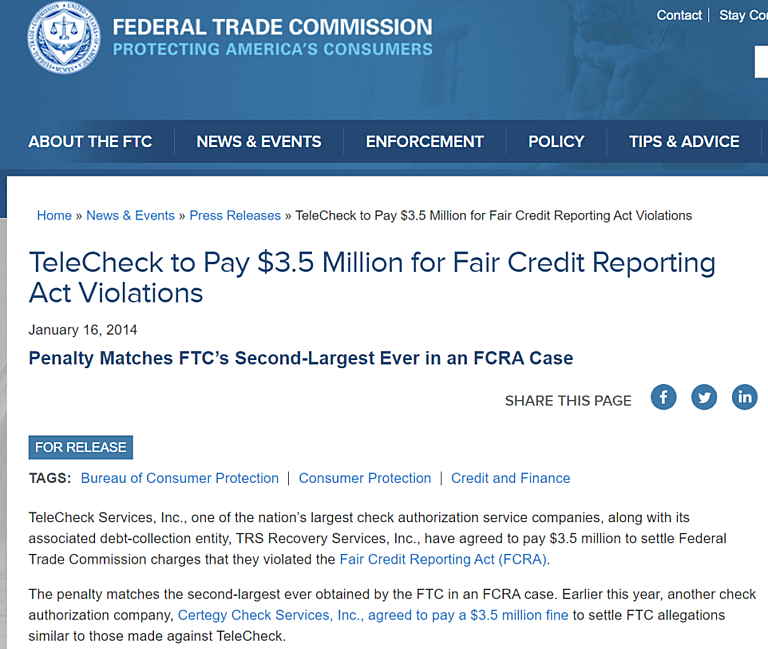

Yes, this is a requirement of the Fair Credit Reporting Act, but consumer reporting agencies may ignore it for some reason. For example, at one time, the media and TV stations reported that TeleCheck was in breach of its obligations, for which it was fined a huge amount of money.

The process of investigating the information you’ve provided takes up to 30 days. So, you can expect to get your report within a month, but in most cases, it arrives faster.

Are There Any Non-TeleCheck Banks?

Yes, they are called second chance banks. But the problem is that most of them work with other reporting agencies like ChexSystems and Early Warning Services. So, there is no point in ‘hiding’ from TeleCheck, because you will run into other, bigger agencies. But still, here are some of the non-TeleCheck Banks:

- Chime is an online financial company that welcomes new customers without checking their consumer reporting account with TeleCheck. The company is rumored to work with other agencies, but it’s a rare case to be rejected by Chime. Consider the Chime Spending Account which comes with a debit card and no maintenance and no monthly fees. The company is growing and is interested in attracting more and more customers by giving them the second chance if they have problems with traditional banks.

- Varo Bank – they call themselves ‘second-chance banking that doesn't cut corners’. Small problems are never a reason to get rejected. You can apply for a Varo Checking Account which has no monthly maintenance fees.

- Renasant Bank is known for not working with TeleCheck, EWS, or ChexSystem. Opening a checking account is easy, but you will have to pay $8 a month (you can avoid paying the fee if you maintain a daily balance of over $500) and deposit at least $50.

Are There Any TeleCheck Free Stores?

Getting rejected at the bank is not good, but it’s not such a big deal. It’s quite another thing when your check is rejected at the store, especially when you are on your way home to feed your family.

That is why many people are looking for stores that don’t use TeleCheck. There are big retailers and small stores. If you reside in a small area, it’s always better to ask an owner or a representative if they work with TeleCheck.

If you prefer to get services at different locations, here is the list of major retailers that don’t work with TeleCheck.

Name | Type of Service | Check Cashed | Requirements |

Neighborhood grocery store and Pharmacy | Payroll checks; Government checks | Giant Eagle Advantage card | |

Grocery Delivery | Printed payroll checks; Government checks | To use a check, you must present a valid photo ID. | |

No-frills grocery store where the customers bag their own groceries at the checkout | Personal checks | To use a check, you must present a valid photo ID. | |

Online and in-club for all your needs from groceries and paper products to TVs and tires | Personal checks | Present a valid photo ID with a check; Be a member of BJ’s | |

Supermarket chain | Personal checks | To use a check, you must present a valid photo ID. |

As you see, even though Walmart is not on this list, customers experiencing problems with TeleCheck always have plenty of opportunities in different locations.

Frequently Asked Questions

Does TeleCheck have access to my bank account balance?

Absolutely not! The company only knows what has been reported by financial institutions it works with. It doesn’t include additional information about your bank account balance, just what you are guilty of, for instance, cashing a bad check.

How do I clear my TeleCheck report?

First, request your free annual report. Check if you have any debts or any other problems. Pay off your debts and ask the bank to report this to TeleCheck.

What banks do not use ChexSystems or TeleCheck?

There are many of them. But they use other reporting agencies such as ChexSystems or Early Warning Services. You might be interested in finding your bank in our article ‘35+ Top Banks That Don’t Use ChexSystems’.

Does Walmart use TeleCheck?

Yes, it does. On top of that, it works with Certegy, which is another agency designed to enable low-risk and low-cost transactions between consumers and businesses.

How does TeleCheck verify a check?

They have a giant database that is constantly updated by various check providers. In short, they check for the absence or presence of unpaid debts and make decisions based on risk. Other factors that the company considers are historical check data, statistical profiles, and so on. It doesn’t share its formula or strategy in detail.

How to Find Out If I Owe ChexSystems or TeleCheck

You don't owe them anything. They are not bankers or private lenders. They just track your banking history. Get your free report, check who you owe, and deal with them, not with TeleCheck.

Bottom Line

While TeleCheck may be a lifesaver for merchants, it has equal importance for check owners in keeping them abreast of their accounts. The system can help you identify any suspicious activity and save you from identity theft or serious financial damages. You can always contact TeleCheck on their helpline numbers for your queries and issues. With the constant advancement of technology, electronic financial crimes have increased, and this check processing system staves off danger considerably.

References

- TeleCheck: What You Need to Know by Lauren Ward. Accessed September 2, 2021;

- How to Get Your Free TeleCheck Report by Pete Low. Accessed September 9, 2021;

- How to Clean My Telecheck History by Kesha Ward. Accessed September 11, 2021;

- What Is Telecheck? The Complete Guide by Mike Pearson. Accessed June 16, 2021;

- A Mistake on Your 'Debit Report' Can Have Frustrating Consequences. Here's What to Do If You Find One by Shannon McNay. Accessed September 10, 2021.