The Best Second-Chance Bank Accounts of 2024

Daniel Long

Updated May 02, 2024

Opening a checking account may be quite a challenge. If you’ve ever experienced any problems with paying off your credit card debt, student loan, etc, even if it was in the past, there are some clues left behind.

Most of the banks use centralized databases that allow them to get access to your credit score, fraudulent activity, unpaid fees, and other information. The most popular ones are ChexSystems, TeleCheck, Early Warning System (EWS).

In other words, they are consumer reporting agencies that contain information about past mistakes that you have made and may have forgotten about. They track your history across both savings and checking accounts.

If you have a bad record in a credit reporting agency, there is a high probability that your application for opening a checking account will be rejected. Even if your net worth is pretty high, many traditional banks may deny your application.

Nowadays, it can be really hard to find a bank that doesn’t use credit reporting agencies. But have no fear! Other options might be even better. A second chance bank account is a version of a standard checking account offered by a financial institution that doesn’t work with ChexSystems. The bank can still check your history, but because it is a second chance bank, it offers an account with a slightly higher monthly payment.

At the end of the day, it’s not about giving out a loan or mortgage, but about letting you manage your funds!

16 Best Second-Chance Checking Accounts for a Fresh Start

Editor's Choice

CIT Bank

The CIT Bank Savings Connect account is the best among banks that don’t use ChexSystems. Unlike many other non-ChexSystems accounts, the CIT Bank Savings Connect is also a high-yield savings account that can help grow your savings much faster than most other banks can.

Features and benefits:

- Interest-bearing

- Minimum balance requirement: $0

- Monthly maintenance fee: $0

- Monthly ATM charge reimbursements of up to $30

Why is it recommended for you?

Although CIT Bank has a relatively high minimum deposit ($100) to get started, it offers one of the best interest rates among online banks, and has no opening, monthly servicing, online transfer or incoming wire fees.

Radius Bank Rewards Checking Account

Radius Bank, which was founded in 1987, is one of the fastest-growing financial institutions in Massachusetts. It’s mostly known as a humongous personal loan company offering a wide variety of services for different types of customers, including those who have a bad credit history.

The key feature of a checking account is an opportunity to earn 1% and more on everyday purchases. Radius Bank offers an FDIC-insured checking account designed especially for those who don’t meet the qualification for its Rewards Checking Account.

- The bank does check banking record, but it shouldn’t be perfect to get approved

- You can get a daily debit card that has a limit of $500

- The monthly service charge is $9.00

- The minimum opening deposit is $10

- After a year of positive banking history, you may apply for a Rewards checking account at Radius Bank

Radius has a 4-star overall bank rating by NerdWallet. It’s important to note that recently it has become a part of LendingClub, one of the leading American peer-2-peer lending companies.

GoBank Ultimate Mobile Bank Account

GoBank is not a traditional bank. It is one of the most known and leading financial companies in the non-banking industry providing several pretty attractive banking services. Instead of a checking or savings account, it offers the so-called Ultimate Mobile Bank Account that combines features of the two.

You can apply for a free debit card, which is a full-featured checking account since you can use it to deposit cash at over 100 thousand retailers across the United States. Fees differ depending on the retailer and usually are not more than $4.95 per transaction.

- Monthly membership cost - $8.95 (waived if your account receives government direct deposits or payroll totaling $500 or more)

- Minimum balance requirement - $20

- Checks can be cashed with the Ingo Money App

- Cash deposits are available across the United States except for Vermont

- No physical branches, it’s a fully online financial institution

GoBank is owned by Green Dot Bank and Bonneville Bank.

Wells Fargo Clear Access Banking

Wells Fargo is a well-known and reputable provider of banking services across the United States. It’s been offering the Opportunity Checking Account for a long time, but it doesn’t anymore. Instead, you can apply for the Wells Fargo Clear Access Banking.

It is a new product designed especially for those who don’t need check-writing ability and want to avoid non-sufficient funds.

- Initial deposit - $25

- Monthly service fee - $5 (can be waived for owners 13 to 24 old)

- Over 13 thousand ATMs for withdrawing your cash

- Over 5,400 branches across the US

- With this account, you get full access to Wells Fargo mobile app which provides you with an opportunity to pay bills to get your monthly spending report, and many more

Unlike other second chance banks, Wells Fargo, which is a humongous financial institution with a market capitalization of over $190 billion, is pretty much interested in helping its clients improve their banking history and apply for regular opportunities.

Peoples Cash Solutions

Peoples Cash Solutions offers a fresh start at banking even if you’ve started before and left some negative feedback.

Peoples Cash Solutions provides you with a free MasterCard debit card that can be used in different ways such as paying bills online, shopping, etc.

The fastest and cheapest way to add funds to your checking account is direct deposit. Also, you can avoid paying check-cashing fees by setting up a direct deposit with your employer.

Features

- Minimum opening deposit - $30

- Monthly fee - $4.95

- No signature-based fees

- Online banking can be accessed at an official Peoples Bank website

- Every client receives a real checkbook and can write checks

- An account is insured by FDIC (up to $250 thousand)

Unlike other similar services, Peoples Cash Solutions takes some time to review an application. Your welcome packet including checkbook arrives in up to 7 business days. Getting a MasterCard debit card takes up to 14 business days.

The weird thing about Peoples Cash Solutions is that they don’t have a mobile app.

Bank of Texas Opportunity Checking Account

Bank of Texas believes in second chances and offers The Opportunity Checking Account. Regardless of your ChexSystems record and previous relationships with American banks, you can start over, get approved, and build your history.

The opportunity checking account allows you to have convenient access to your money while reestablishing a solid checking history.

- Minimum opening deposit - $50

- Free Visa Debit Card and unlimited transactions

- Monthly service fee - $14.95

With Online Bill Pay you get access to paying your bills, making mobile deposits, and getting instant notifications. The fee is $3.95 monthly.

BancorpSouth Second Chance Account

BancorpSouth is known as a bank that offers personal lending, mortgage, insurance, business banking, and a second chance checking account. Even though its official website says that the bank does use a ChexSystems database and will reject an application if it’s not approved through ChexSystems, multiple online reviews show that BancorpSouth is loyal to new customers, especially those opening a new checking account.

- Monthly fee - $10

- Minimum opening deposit - $50

- Free debit card

- Free online banking

In a year, a second chance checking account can be reviewed and upgraded to a standard checking account which comes with some additional features. The bank is interested in helping clients build better financial relationships and encourages you to upgrade to Budget smart, My way, Performance, Interest plus, Heritage, and other checking accounts as soon as you show your trustworthiness while using its Second chance account.

The bank has a 3.5-star rating at Smartasset.com which is a weighted average of customer support, fees, rates, financial health, and other factors.

United Bank Gateway Checking Account

By opening a Gateway Checking Account at United Bank you start your way to a standard account available for those clients who don’t have problems with ChexSystems.

Only six months is needed to be upgraded in case of proper maintenance.

- Monthly maintenance fee - $10

- Free online banking

- Online Bill Pay for $4.95 per month

- Multiple check options

- Itemized statements

- If an account is closed within 6 months after opening an additional fee of $100 will be accessed

Important to notice that with the United Bank Gateway checking account you don’t get a free debit card. But you do get 24/7 phone customer service and account alerts.

Rio Bank Fresh Start Checking Account

Clients with imperfect or negative banking history can apply for a Fresh Start Checking Account offered by Rio bank.

With it, you get access to online banking, mobile banking, Bill Pay, eStatements, Automated TeleBanc, and a surcharge-free ATM network.

- Minimum balance requirements - $100

- Monthly debit card fee - $1.76

- Monthly service charge - $11.76

Also, you can apply for other options even though technically they are designed for different strata of customers:

- Rio advantage checking account

- Prestige direct checking account

- Bonus checking account

- Prestige checking account

- eChecking plus account

- Prestige money market account

- Young generation checking account

Fort Sill National Bank Basic Checking Account

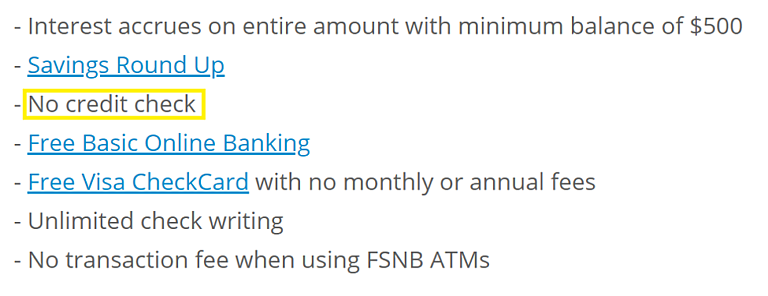

With Fort Sill National Bank, you can open a Basic Checking Account that doesn’t require any credit check.

It’s important to note that not every bank is happy to be called a second chance bank that offers second chance products. This is why some financial products that are second chance checking accounts are called differently. For example, Fort Sill National Bank offers its Basic Checking Account which doesn’t involve credit check:

To open a Basic checking account offered by FSNB, you have to deposit as little as $5.

Other features

- Monthly maintenance fee - $6 (waived when your balance is above $75)

- Free digital statements

- Free Visa check card

- Paper statements - $3.50 per cycle

Varo Bank Checking Account

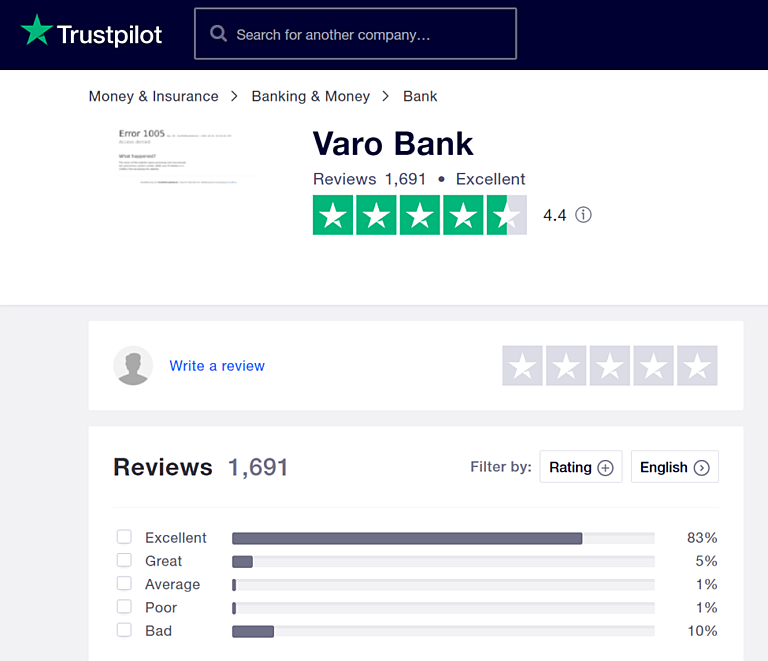

Varo Bank is known for not using ChexSystems when reviewing customers’ applications and is often called a second chance bank. On top of that, it doesn’t check your FICO score, credit report, or banking history.

It’s a fully online bank with no branches.

A Varo Online Checking Account allows you to pay bills, complete banking transactions, deposit a check, etc.

- No minimum balance requirement to open and keep an account

- No monthly fees

- No fees when transferring your money between Varo accounts

- Visa debit card

- Early paycheck with direct deposit

Varo Bank has a 4.4-star rating at Trustpilot and is considered “Excellent”. Typically, clients say, it’s an easy-to-use app with great customer support and no hidden fees. Some reviewers complain that it may take 30-60+ minutes to wait on hold to speak to a real person.

Liberty Savings Bank Clean State Checking Account

Liberty Savings Bank offers a Clean State Checking Account which allows you to get easy access to your money and improve your financial standing.

This opportunity is for those who have bad records with ChexSystems and even have been reported for account abuse three times or fewer.

- $100 minimum deposit

- $10 monthly service fee

- Free online banking

- Free mobile banking

- Free Bill Pay

- Free MasterCard debit card

- Unlimited number of checks every month

- Access to 55 thousand surcharge-free ATMs

If you qualify for this account and establish yourself as a trustworthy customer, in the future you can apply to a Free checking account that is offered with no monthly fees and no minimum balance.

An interesting feature about Liberty Savings Bank is that it offers 1.00% APY on checking balances up to $25 thousand which is 25x the national average.

The bank has a 4.2-star overall rating by Smartasset.com

Eastern CT Savings Bank Restart Checking Account

Eastern CT Savings Bank offers Restart Checking for clients who have ever experienced problems with banks. There are only two requirements:

- No monies owed

- No fraudulent activity

In this way, it’s quite clear that Eastern CT Savings Bank does check your ChexSystems history, but only to check for these two points.

Restart checking account features

- Minimum balance to open an account - $25

- Monthly service charge - $6.95

- 4 free ATM withdrawals each statement cycle

- Free mobile banking

- Free online banking

- Unlimited check writing

In 12 months after opening an account, you can request an upgrade to another Eastern CT Savings Bank Account such as Kasasa Cash Checking, Kasasa Cash Back Checking, or ez Access Money Market.

Eastern CT Savings Bank has a 5-star review at Google Maps.

Community Bank & Trust Second Slice Checking Account

Community Bank & Trust offers Second Slice Checking which is a second chance account. The bank doesn’t check ChexSystems reports and welcomes new customers.

Features

- Minimum deposit to open - $100

- Unlimited check writing

- Mobile app

- Debit card

- Image statements

- E-statements

In case you don't violate any requirements, in the future, you can apply for other options which are Person Checking, Checking Plus, Golden Apple Checking, Heroes Checking. With them, you can manage your finances, earn interest on your money and get access to additional features that are not available with a Second Slice Checking. One of them is a discount on safe deposit boxes.

Pay attention, an official website of the Community Bank & Trust is located at redapplebank.com which is a bit unusual for the banking industry.

Washington Savings Bank Online Rewards Checking Account

Washington Savings Bank allows everyone to start fresh and apply for its Online Rewards Checking. People claim it’s pretty easy to open an account, even though the bank checks your history with ChexSystems, but the requirements are relaxed.

- Minimum deposit - $10

- No minimum balance requirement

- Monthly maintenance fee - $14.95

- Free Mastercard debit card

- Free mobile app

- Free electronic Statements

In a year of good standing, you are allowed to apply for upgrading your account to a Free checking plan.

Washington Savings Bank has a 3.5-star rating at Yellow Pages. Customers are happy about its customer support, high level of service.

Pay attention, there are a dozen financial institutions called Washington Savings Bank across the United States. This bank’s website is located at a washingtonsavings.com domain name.

Best Alternatives to Bank Checking Accounts

A checking account is nothing more, but a digital pocket. It allows you to do the same thing that your parents and grandparents did with paper dollars. While it’s still possible to use paper money, in most cases, you’ll be asked to pay with a card. Online payments are merely impossible to imagine without having a Visa or MasterCard card.

In this way, checking accounts offered by banks are not the only possible way to get easy access to your money. What you need is a card linked to any other type of account whether inside or outside the banking system.

4 Best Second Chance Checking Accounts at Credit Unions

There are over 5 thousand credit unions with over $1 trillion in assets across the United States. They serve over 100 million members.

In short, a credit union is a non-profit organization that allows participants to invest and borrow money. Being non-bank organizations, they offer traditional bank products such as checking and savings accounts.

In some cases, credit unions serve clients in a specific area. In this way, it makes sense to search for a credit union in your area. Pay attention, these financial institutions do not advertise themselves as a ‘second chance option’. They are just an important part of a financial system outside the banking industry. In this way, they can be considered a second chance.

Some credit unions do use ChexSystems to determine whether or not a particular client is eligible for opening an account, but their rules and requirements are a lot less strict.

GTE Financial Go Further Checking Account

GTE Financial offers the Go Further Checking Account, which is advertised as an account with simple approval terms. There is no data on whether the company works with ChexSystems, but it can be called a low-cost second chance account.

- Monthly maintenance fee - $9.95 (can be avoided as long as you deposit $500 every month)

- Free online banking

- Free mobile banking

- Remote deposit with the app

- Money transfers via the Popmoney service

- Free debit card

- Built-in rewards

Every client is eligible for upgrading their account after being a reliable client for the first 12 months.

GTE Financial offers credit for referrals, which means you can make money by getting your unique code in a ‘Member Rewards Center’ and sending invitations to your family, friends, and any other potential members.

GTE Financial is one of the largest and most known credit unions in the country, which serves over 250 thousand customers. It was founded in 1935 and now has over $2 billion in total assets. This credit union has a 3.4-star rating at Bankrate and is loved for its low fees, access to fee-free ATMs, a wide variety of products and options.

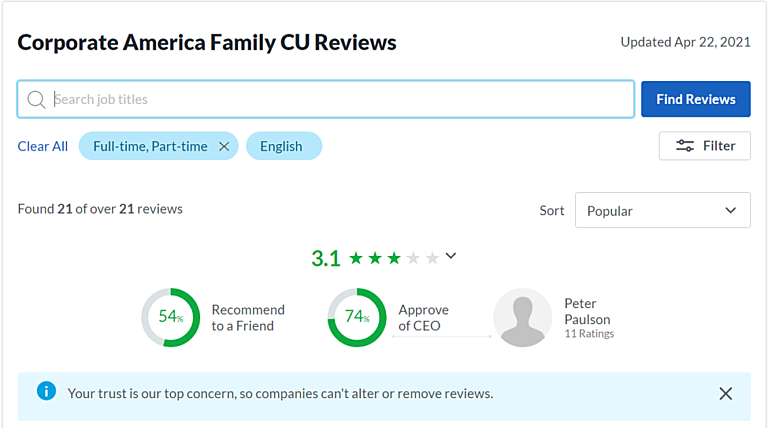

Corporate America Family Credit Union Fresh Start Checking Account

Fresh Start Checking Account offered by Corporate America Family Credit Union is a straightforward way to start your journey toward rebuilding a positive checking history.

There are some membership requirements to be qualified for, but they are not tough. With a Fresh start checking account, you get a bunch of free features:

- Free Visa debit card

- Free bill pay

- Free mobile banking

- Free online banking

- Minimum balance requirement - $100 (must be held in a Regular share account)

- Monthly maintenance fee - $10

To qualify for this account, you must be a member of CAFCU. This requires a donation of $5 to The Hope Group. Your money will be spent to fund scholarship programs.

54% of Glassdoor members would recommend Corporate American Family Credit Union to a friend. The service has an overall rating of 3.1 stars.

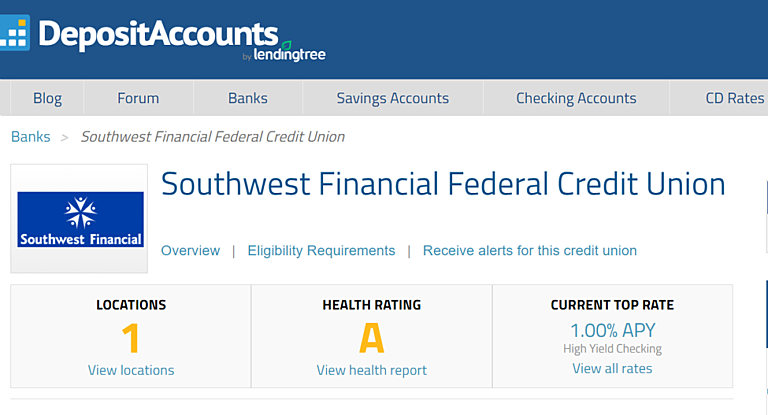

Southwest Financial Federal Credit Union Checkless Checking Account

Southwest Financial Federal Credit Union offers 3 checking accounts for different customers.

Opening a new account doesn’t involve using ChexSystems. People who are experiencing troubles qualifying for a regular bank checking account can apply for its Checkless Checking Account.

- No monthly service fee

- Overdraft protection

- Online banking

- Mobile app

- No checks

According to DepositAccounts, Southwest Financial Federal Credit Union has an ‘A’ health rating.

Navy Federal Credit Union Free EveryDay Checking Account

Navy Federal Credit Union is the largest credit union in the United States with over 9 million active members. There are different options:

- Free Active Duty Checking for retired military workers

- Free Easy Checking for everyone

- Free Campus Checking for students and other members ages 14-24

- Flagship checking - for those aiming to earn more money on their money

With so many options, it’s easy to get overwhelmed, but the great thing is that every member is eligible for a Free EveryDay Checking Account:

- No minimum deposit to open

- No monthly service fee

- No overdraft service

- Stop payment fee - $20

- Optional Overdraft Protection Service - $20

You can request a debit card, use it in your everyday life and nobody won’t even notice that your applications to open a bank checking account have ever been rejected. Millions of people act this way and feel quite comfortable.

Prepaid Debit Cards as an Alternative to The Best Second Chance Banks

Debit cards are often confused with checking accounts, but with a debit card, you can make purchases online, at stores, and withdraw cash. Checking accounts offer a lot more services such as writing checks, transferring money, making online purchases, etc.

Typically, a debit card is linked to your checking account but you can get a prepaid debit card without applying for a bank checking account. For example, a Payoneer debit card is designed to be used by those who work online. When opening an account, you are required to link to your existing bank account, but you can legally bypass this requirement. This is confirmed by a support team:

Except for Payoneer, there are other popular and heavily used prepaid debit cards:

- NetSpend Visa Prepaid Card - monthly fees range from $0 to $9.95 depending on which plan you choose. In other words, the fee type is pay-as-you-go. No overdraft fees, over 130 thousand cash locations. Purchase transaction fee - $1.50, ATM withdrawal - $2.50 per transaction.

- Brinks Prepaid Mastercard - monthly fee from $0 to $9.95 (depends on plan option). Purchase transaction fee - from $0 to $1.50, ATM cash withdrawal fee - $2.50, card reload fee - $3.95, early direct deposit available up to two days before payday.

- American Express Serve Prepaid Debit Account includes a reloadable card that is known for its low fees. No credit check required, annual fee - $6.95, monthly fee - $0 (with $500 direct deposit). The card is accepted everywhere where American Express cards are accepted.

Your Existing Credit Card Instead of a New Checking Account at a Second Chance Bank

While it might sound tricky, using your existing credit card or applying for the new one is a considerable alternative to checking accounts.

Even if your credit score is pretty bad and you have some negative records in ChexSystems, you are always welcome to get a credit card. Using it properly requires financial intelligence, persistence, and some level of understanding of how it works. Every credit card has a grace period, which is a period between the date your payment is due and the end of a billing cycle. No interest is charged as long as you pay in time.

Understanding how a grace period works in a certain situation and how to use it in your everyday life does require some expertise, but when the skill is mastered, a credit card becomes a convenient financial tool that has a positive effect on your credit history.

From this perspective, it may be better to apply for a credit card or keep using your existing one rather than looking for a second chance bank.

Best credit cards for bad credit are easy to find and easy to apply for.

- Secured Mastercard from Capital One - annual fee $0, purchase rate - 26.99%. If you make a minimum required security deposit, you will get a credit line of $200. The credit line is automatically renewed. The card has an overall rating of 4.2 stars at CreditKarma and is recommended by over 1,800 reviewers.

- Discover It Secured Credit Card - with it you can earn 2% cash back on restaurants and gas stations and unlimited cashback on other purchases. An overall rating of 4.1 stars at Creditcards.com makes it a pretty considerable opportunity for customers with bad credit. With no annual fees and a regular APR of 22.99%, it helps you build your credit history in short periods of time.

- OpenSky Secured Visa Credit Card is a great opportunity for customers with bad credit history and low credit score since no credit check is necessary to apply and get approved. With an annual fee of $35 and a regular APR of 17.39%, it helps you build your credit in 6 months. The great thing about this credit card is that there is a strong Facebook community of people using this product and helping each other to avoid common financial mistakes.

Joint Bank Accounts - A Surprisingly Easy Solution for Those Looking for the Best Second Chance Banks

If you are not eligible to open a checking account at a bank of your choice, this does not necessarily mean that you cannot use it. Sounds tricky? A joint account is an account shared between two, three, or more individuals.

Joint accounts are often used by couples, family members, business partners, or other people who trust each other.

This refers not only to checking and savings accounts but also to credit cards, lines of credit, and even mortgages.

The most difficult part is finding a reliable partner who you can trust. Asking your friend, coworker, or parent to open a joint bank account is never a good idea, especially if you’ve ever experienced difficulties with banks. So, in most cases, this financial product is used by couples who trust each other.

Worth mentioning, five different surveys found that those couples who use joint bank accounts are not only happier but also less likely to break up.

Important to know

- If you have a poor credit history, your application to join an existing account might be rejected. But this won’t affect your partner’s score.

- When you open an account with your partner, your credit ratings will be linked. While such ‘co-scoring’ might work well for you, it may not be a preferable option for your partner.

- If your credit score is low and you cannot properly manage your finances, your partner may help you develop necessary financial habits by tracking your everyday expenses. This is true only when you have very close relationships with your partner.

Financial Companies vs Second Chance Banks

PayPal - The Most Popular Online Payment System in the World

PayPal is a world-leading online payment system, especially popular in the United States. With it, you can send your money to your family and friends, make online payments, receive money, and even set up a merchant account.

Paying your bills with PayPal is not a problem, since most utility companies accept PayPal payments. Yes, you need a bank card, but it can be a credit card issued by any American bank or a prepaid debit card not linked to a bank account at all. You might think that paying with PayPal at a local store or a fast-food restaurant is a weird idea but McDonald’s, Home Depot, and many other well-known American brands accept payments via PayPal. For example, to buy a coffee at the nearest McDonald’s you will have to use the Pay with Square mobile app.

PayPal key features

- Seller fee - 2.9%

- No buyer fee

- Fee for accepting money from a different country - 1.5%

- Bill Me Later

- Mobile card reader

- Online invoicing

- Barcode scanning

- Express checkout

Even though PayPal is not a bank, with over 300 million accounts it’s often called the largest bank in the world. It’s the largest financial service in the entire world.

It has a 4.7-star rating at GetApp which is a weighted average of customer support, features, ease of use, value for money, and other features.

M1 Finance - Be Your Own Bank!

M1 Finance is advertised as a mobile app that offers easy access to investing in the stock market. But you can invest, borrow, spend and be your own bank. The company offers M1 Spend, which is a checking account insured by FDIC.

You can get a Visa debit card that allows you to pay your bills, spend your money online and direct your paycheck to an account. On top of that, recently M1 Finance launched a premium version. As part of it, you get 1% cashback on qualifying purchases and 1% APY interest.

When you invest your money with M1 Finance, you can borrow against your portfolio, which is risky, though profitable, rather than just letting your money sit in your checking account and wait to be withdrawn. This makes sense especially if you invest in safe assets such as the SNP500 index ETF.

M1 Finance is aiming to revolutionize the way people think about managing their money and have plenty of positive reviews.

- Minimum balance - $100

- Maintenance fee - $0

- $30 bonus when you deposit $1,000

- Automated investing at no additional fees

Revolut Debit Card

Revolut is a financial company that allows you to manage your money easily and effortlessly. With its debit card, you can use it as a regular checking account at a regular American bank.

It is designed to help clients send money to each other, pay for everyday needs, buy products and services both online and offline.

Over 15 million customers across the globe, no hidden fees, fee-free international money transfers make Revolut a pretty considerable alternative.

You can create a Revolut account from your iPhone and get approved automatically. No credit check is involved.

- Get your salary in advance via direct deposit (up to two days) - no cost

- Built-in budgeting (as a client you can always see how much money you spend each month for restaurants, groceries, video games, etc)

- Send and request money from family and friends (if you both have a Revolut account, transferring money between accounts is free and instant - no processing fee, no wait time)

- Get as many virtual Visa or MasterCard cards as needed at no cost. Even for every purchase you make

- Branch-free money management

Revolut has over 80 thousand reviews at Trustpilot and a rating of 4.3 stars. 78% of reviewers consider it an ‘Excellent’ service.

Wise (Formerly TransferWise)

Wise is a London-based company which initially focused on providing international money transfer. In 2021 it was rebranded from TransferWise to Wise to reflect its expanded product offering.

Now you can join 10 million customers worldwide and get a Wise Debit Mastercard. It lets you spend the money sitting in your account. It is not tied to a bank account and doesn’t involve checking your banking history.

Wise advertises itself as a much cheaper alternative to banks due to lower commissions, ease of use, and multiple other features.

Wise debit card features

- Card Issue - $7

- Annual fee - $0

- Minimum balance requirements - $0

- Free cash withdrawals - up to $350 every 30 days (later 2%)

This card can be used like any debit card. It’s accepted wherever Visa cards are accepted. On top of that, it can be compared to a travel card. You can easily receive money from your international partners and spend it using a card.

Peer-to-Peer Lending Services - Invest and Borrow Whenever You Need It

Peer-to-peer lending is getting ridiculously popular across the United States. It’s mostly designed to invest money in businesses or individuals, which means you can always earn interest on your fundings and borrow as much as you are allowed to depending on your rating.

Peer-to-Peer lending platforms are not designed to borrow every time you need to make an online or offline payment, but they can be considered an alternative to both checking and savings accounts. Especially if you have some additional money to sit in an account to earn you some interest.

While using p2p lending services to borrow money without proper financial discipline is never a good idea, you can use it to pay off your credit card debt, start renewing your credit score.

- Kiva is a San Francisco-based p2p service designed especially for first-time borrowers with low or no credit.

- Upstart is an innovative p2p platform founded by ex-Google employees. It has created its own system that tracks customers’ financial behavior.

Best Second Chance Banks and Credit Unions - Comparison

Account | Minimum deposit to open | Monthly maintenance fee | Benefit |

$0 | $0 | no fees | |

$10 | $9 | part of LendingClub | |

$20 | $8.95 (can be waived) | represented by two big banks | |

$25 | $5 | monthly fee can be waived for owners 13 to 24 old | |

$30 | $4.95 | part of Peoples Bank | |

$50 | $14.95 | best for easy approval with a horrible banking history | |

$50 | $10 | can be reviewed and upgraded | |

$0 | $10 | for customers with low or no credit | |

$100 | $11.76 | easy upgrade to other options for reliable customers | |

$5 | $6 | no monthly or annual fees for a Visa CheckCard | |

$0 | $0 | zero fees to open and maintain | |

$100 | $10 | 1.00% APY on checking balances up to $25 thousand | |

$25 | $6.95 | 4 free ATM withdrawals per each statement cycle | |

$100 | $0 | easy upgrade to other options for reliable customers | |

$10 | $14.95 | upgrading to a free checking plan in a year of good standing | |

$0 | $9.95 (waivable) | easy approval, easy upgrade after being a reliable client for the first 12 months | |

Corporate America Family Credit Union Fresh Start Checking Account | $100 | $10 | review and upgrade for reliable clients |

Southwest Financial Federal Credit Union Checkless Checking Account | 0$ | $0 | ‘A’ health rating by DepositAccounts |

$0 | $0 | no fees to open and maintain |

How We Chose and Ranked the Best Second Chance Banks

We considered 10 different factors in compiling the ranking:

- Service quality. The more positive reviews, the better. We were thoroughly reviewing hundreds of different reviews on TrustPilot, SmartAssets, GetApp, GlassDoor, social media, and discussion board communities.

- FDIC insurance. The Federal Deposit Insurance Company examines financial institutions and insures deposits. If a bank is supervised by FDIC, your money is protected. The FDIC kicks in only in case a bank fails.

- Financial health. Simply put, it is a measure of a second chance bank’s ability to meet its obligations, especially during financial crises and other unexpected events.

- Hidden fees. Nobody likes to be charged more than expected. Hidden fees are nowhere welcome, especially when it comes to managing your own money. We have paid special attention to ATM fees and card issuance fees.

- ATM fees.

- Minimum balance requirements.

- Minimum maintenance requirements.

- Ability to upgrade an account in case of proper maintenance.

- Ease of use of online banking

- Ease of use of mobile apps.

Buyer's Guide to Selecting the Best Second Chance Bank

When looking for the best second chance bank to apply for a checking account it’s never a good idea to be in a hurry. The thing is, even if your banking history is horrible, you still will find a way to get access to managing your money the way you want. There are a lot of heavily advertised mobile apps either independent or owned by big banks that rarely reject applications. But even if you establish yourself as a reliable client, this won’t have any impact on your ChexSystems or any other report. In short, you don’t build your credit.

On the other hand, it always makes a lot more sense to apply for a second chance account that can be reviewed and upgraded in case you establish yourself as a trustworthy and reliable person. In this way, in a year or two, you will be able to apply for a regular checking account at the same bank or another bank of your choice.

In fact, every financial institution is interested in attracting new customers and offering various services, especially when it comes to allowing them to use their own money. From this perspective, despite the fees and other conditions, Wells Fargo, United Bank, BancorpSouth, and some others offer better opportunities than new-age mobile apps charging no fees for opening and maintaining your account.

Paying monthly maintenance fees doesn’t cost an arm and a leg, but still, in some cases, this can and should be avoided. Some banks (GoBank, Fort Sill National Bank) waive the fee if your balance is above $50-500.

Since your banking history is negative, your second chance checking account will have lower spending limits and fewer features. But this should not always be considered a disadvantage. Remember, in most cases, you’re always welcome to ask for renewal and upgrade at a particular financial institution.

There are both big and small banks offering second chance checking accounts. It’s not something bad to be ashamed of, it’s just an opportunity to start fresh after you’ve experienced financial troubles, lack of financial discipline, etc.

Applying for an account and getting rejected doesn’t harm your credit score or banking history.

With a second chance checking account, you get access to most of the features. In most cases, this includes a debit card, checkbook, online banking, mobile app, online bill pay, and other benefits for everyday use. Especially when it comes to Chime Spending Account, GoBank Ultimate Mobile Bank Account, and other services offered by mobile apps.

Should You Use a Second Chance Checking Account?

Although using a second chance checking account seems like an easy way to manage finances, such solutions have both advantages and disadvantages.

Advantages | Disadvantages |

You can get a debit card, write checks, buy products and services online and offline. | Some options such as spending capabilities and transactions may be limited. |

A lot more convenient than paying with prepaid debit cards or paper cash. | Overdraft transactions are often declined. In some cases, no overdraft protection is offered. |

In many cases, reliable clients can upgrade to a regular offer (in 6 or 12 months). | In some cases, monthly fees cannot be avoided. |

Your money (up to $250 thousand) is protected by FDIC. | The account doesn’t pay you interest. |

Best Practices for Using Your Checking Account at a Second Chance Bank

- Before opening an online account, consider meeting in person with a personal banker to discuss your options. You may be eligible to open a traditional checking account with a specific bank.

- Know your spending limit and daily cash withdrawal limits. Use your mobile app or online banking every day or several times per week.

- Always know how much money you have in your account. Don’t spend money you don’t own.

- Avoid ATM fees at all costs. Only use ATMs that are part of your bank's network.

- Reload your account with additional funds in advance. This will give you peace of mind before you make any online or offline payments.

- Simplify your finances and use only one checking account. This will help you control your spending much more easily.

- Consider using a second chance checking account as a temporary solution for a short period until you get back on track and apply for any checking account at any bank of your choice.

What are ChexSystems, TeleCheck, EWS?

Before you apply for a checking account at a second chance bank, it’s always a good idea to find out the reason why you were denied. Every 12 months, you can request a free report at credit reporting agencies. This will help you find out which bank or banks you owe. The bank can remove their report on you once you pay what you owe. They usually don't, but they can if you ask them to.

- ChexSystems is the most popular consumer credit reporting agency in the United States. Over eighty percent of American commercial banks and credit unions use its reports to check their customers. Request a free report at ChexSystems!

- TeleCheck is a company that assists financial institutions, retailers, and other businesses with opening accounts and accepting payments. To figure out what is wrong with your banking history, you can request a free report at TeleCheck.

- Early Warning System (EWS) is a reporting agency providing reports about consumers’ checking accounts and savings accounts. It was created by Bank of America, Wells Fargo, Capital One, Chase, and other American banks to reduce risks and prevent fraud. Request your free report at EWS!

Second Chance Banks vs Non-ChexSystems Banks

A second chance bank is a general term referring to banks and often credit unions that allow you to open a checking account despite your credit and banking history. They may or may not work with ChexSystems, TeleCheck, or Early Warning Systems, but what is most important is that they don’t have strict requirements and allow applicants to open an account.

A non-ChexSystems bank is a bank that doesn’t work with ChexSystems, but it may work with other credit reporting agencies. Roughly one of five American banks doesn’t work with ChexSystems, but this doesn’t mean that they offer second chance checking accounts. They just check their customers’ reliability differently.

From this perspective, it makes a lot more sense to apply for a checking account with second chance banks rather than just non-ChexSystems banks.

Frequently Asked Questions

Can you get a second chance bank account if you owe another bank?

Absolutely, yes! Owning your bank is never a reason for another bank to refuse you. An average American family has over $6 thousand in credit card debt. About 4 of 5 Americans have debt, but that is no reason for a bank to reject their checking account applications.

What banks do second chance checking accounts?

GoBank, Chime, Radius, Wells Fargo, United Bank, Bank of Texas, and many others. The best of them are listed in this review. Also, you can open a checking account at credit unions.

How do second chance bank accounts work?

Like regular checking accounts. They are a bit stripped-down, have lower spending limits, don’t pay you interest, may require a minimum opening deposit and monthly maintenance fee. Most banks are interested in allowing customers to get back on track and use a regular checking account.

Are there any banks that don’t use ChexSystems?

Yes, there are hundreds of them across the United States. If you ever hear that a bank offers a second chance account, there is a high likelihood that it doesn’t use ChexSystems.

How do I find the best second chance banks near me?

You can use Google Maps. But there is no need to be searching for a bank located in your area. You can always apply online and get a card by mail. Some banks are fully online, they don’t have any branches.

Does Wells Fargo Bank use ChexSystems?

No, it doesn’t. We contacted Wells Fargo customer support to figure out this question and got the following answer:

How long does ChexSystems stay on record?

Five years unless the bank requests removal. You can speed this up if you negotiate with the bank you owe. In this case, you will be able to apply for a regular checking account.

Do second chance banks watch your account?

Yes, they always track not only your transactions but other activities as well. They are required by law to track your transactions. This applies to any bank and any account.

What are good questions to ask before opening a second chance checking account?

- What happens if you try to withdraw more than you have in your account?

- Is there a requirement to keep a certain amount of money (minimum deposit)?

- Is a mobile app available?

- Will you get a free debit card?

- Is there an opportunity to renew and upgrade your account in 6 or 12 months?

Final Words

Don't consider second chance banks as a way to avoid financial hardship. You’re always responsible for paying your debts.

On the other hand, there is no need to join 14.1 million American adults that are unbanked. You can always find the best second chance bank and apply for a checking account that will help you pay your bills, buy online and offline products and services.

Don't pass up the opportunity to start fresh and upgrade your second chance account to a regular option in 6-12 months.

References

- ‘What Is Second Chance Banking?’ by Ben Luthi (Experian) - published on January 23, 2019;

- ‘Second chance checking accounts: How they work and how to find one’ by Satta Sarmah Hightower (CreditKarma) - updated February 23, 2021

- ‘Best Second Chance Checking Accounts’ by Margaret Wack (Investopedia) - updated May 10, 2021;

- ‘Best Second-Chance Bank Accounts’ by Justin Pritchard’ (The Balance) - updated May 24, 2021;

- ‘Best Second Chance Checking Accounts’ by Lauren Perez (ValuePenguin) - updated April 26, 2021;

- ‘Second Chance Checking Accounts Across the U.S.’ by Spencer Tierney (Nerdwallet), Chanelle Bessette - published August 13, 2020.